How much does it cost to invest in the United States?

The United States has always been the first choice for global immigrants, which is closely related to its strong economic system, world-leading elite education, and excellent medical resources. Because of these attractions, more and more people are beginning to pay attention to the U.S. investment immigration program. So how much does it cost to invest in the U.S.?

Generally speaking, the United States immigrants need to prepare 880,000 U.S. dollars to 1.21 million U.S. dollars ranging. The specific need to prepare how much money depends on the investor to choose what kind of investment projects and choose what kind of immigration services. Let’s take a closer look at the financial requirements involved in U.S. immigration investment.

Reading List

I. U.S. investment immigration program costs

U.S. immigrant investors can choose to invest directly in the project, or through a regional center investment project.

1. Direct Investment

Investors can choose to invest directly in a new commercial enterprise and participate directly in the day-to-day operation and management. This type of investment usually involves a higher level of risk and liability.

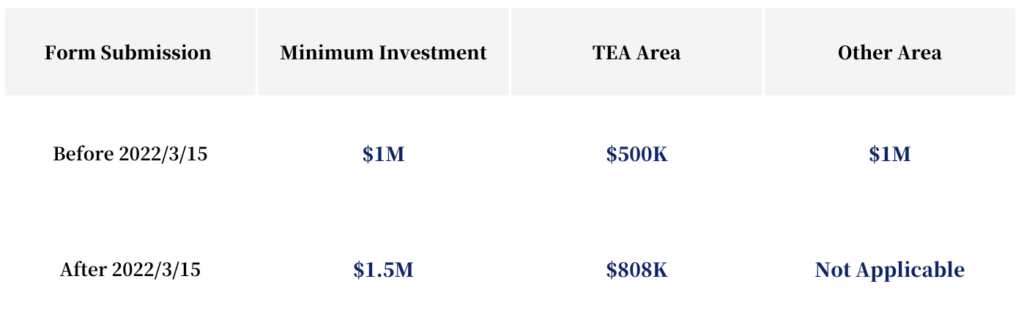

According to the information on the USCIS EB5 Program Introduction website, the minimum investment amounts for different EB-5 programs by filing date and investment location are

2. Standard Investment

If the investment project is located in a non-Targeted Employment Area (non-TEA, i.e., an area that is not rural and has an unemployment rate that does not exceed the national average), the investor is required to invest a minimum of $1.05 million. A minimum of $1.05 million is also required for direct investment options.

Targeted Employment Area Investment: If the investment project is located in a Targeted Employment Area (TEA, i.e., a rural area or an area with a high unemployment rate), the investment amount can be reduced to $800,000 USD.

3. Regional Center Investment

Investors can also choose to invest through EB-5 regional centers, regional centers are approved by the USCIS, used to reduce or eliminate the risk of investing in.

Almost all of the current USCIS-approved “Regional Center” investments are in “TEA” areas, so the EB-5 investment amount for investing in a “Regional Center” project is $800,000. The amount is 800,000 dollars.

II. U.S. immigrant investor service fees

Depending on the region, the investment amount is $800,000 or $1,050,000, depending on the area of investment. However, this is only the base amount of the EB-5 investment, and the actual total cost involves other aspects, such as the service fees of the relevant service providers. The service fees involved in U.S. immigrant investor usually include:

- EB5 program management fees: $60,000 to $100,000

- EB5 immigration attorney’s fee: $10,000 to $30,000

Depending on the client’s payment method and the complexity of the source of investment funds. The attorney’s fee is included until the final permanent green card is obtained, and the service period is 3 to 4 years. (Online search data is for reference only: general attorney fees for an hour of 600 U.S. dollars, senior attorney fees for an hour of 800 U.S. dollars.

- EB5 intermediary service fee: $10,000 to $50,000

- Document translation and notarization fees: depending on the specific circumstances

III. U.S. investment immigrant other costs

CPA accounting audit fee: about 10,000 U.S. dollars

USCIS administrative fee is listed below

(1) If you are in the U.S.

- I-526E application fee: $3,675/per family

- I-485+I-765 EAD Card+I-131 Re-entry Permit combo card application fee: $1,140/per person; $750/per person for applicants under 14 years old.

- Biometric biometric collection fee: $85/per person

- I-829 Filing Fee: $3,750/family

- Green Card Production Fee: $220/person

(2) If you are outside the U.S.

- I-526E Filing Fee: $3,675/per family

- I-765 EAD Card + I-131 Re-entry Permit combo card application fee: $1,140 per person; $750 per person for applicants under 14 years of age.

- Biometric biometric collection fee: $85/per person

- I-829 Filing Fee: $3,750/family

- Green Card Production Fee: $220/person

- Guangzhou U.S. Consulate NVC Visa Fee: $405/person

Visa Medical Examination Fee: to be paid by the applicant himself/herself directly in China, without going through a law firm.

- Beijing Adult 880/person Child 600/person

- Shanghai Adult 1,100/person Child 640/person

- Fujian Adult 1,200/person Child 800/person

- Guangdong Adult 900/person Child 500/person

*Note: Medical Examination Fee varies in different country

(3) Cost Summary

For applications within the U.S., all fees total $11,370 USD. (One family, two adults and <14 year old child)

For Guangzhou Consulate application and Beijing Medical Examination, the total cost is $12,912 USD. (One family, two adults and <14 years old children)

IV. Steps and Considerations for Transferring U.S. Immigrant Investor Funds

Prove Source of Funds

Investors must prove that their source of funds is legitimate. This can be proved by providing financial records, payroll, tax statements, real estate sales contracts, stock trading records and so on.

Opening a U.S. Bank Account

Transferring funds safely to the United States requires the investor to open a bank account in the United States. This usually requires the investor to be physically present in the U.S., but there are some banks that allow remote account opening.

Transfer of Funds

Investors may choose to transfer funds from their account in their country of origin to their account in the U.S. by bank transfer, wire transfer, or other legal funds transfer method. This process may take some time and may incur some processing fees.

Documenting and Proving the Funds Transfer

Throughout the funds transfer process, the investor will need to keep all records and documents, which will be submitted as proof when applying for immigration. This may include bank remittance certificates, transaction invoices, transaction records, and so on.

Overall, immigrating to the United States by investment is a complex and financially demanding process. Different types of immigrant investors have different investment amount requirements and thresholds. In addition, the legal source of funds and a reasonable plan for transferring the funds are also key factors in the success of the immigration process. Therefore, those who wish to immigrate to the United States by investment should conduct thorough research and preparation before applying, and if possible, it is best to seek professional legal and financial counseling.